Rather Than Fall in Mid-2018, Gold Prices Seem Ready to Go Up Before End of 2017

Goldman Sachs Group Inc (NYSE:GS) has said that gold prices will fall in 2018, only to rise again in 2020. The reason for the dip in the price of gold, says the famous investment bank, is that market fear will decrease in the first months of 2018. Gold is the safe-haven investment of choice, or it used to be until Bitcoin came along and dazzled everyone with its cybernetic shine. (Source: “Goldman: Gold Prices To Fall Into Mid-2018, Rally Into 2020,” Kitco Metals Inc, December 20, 2017.)

But Goldman Sachs analysts wrote those predictions on December 20. They must have pondered them in the few days before that, when Bitcoin was pursuing its relentless and mystifying run toward the sun. But, like Icarus and all who dare to breach the laws of nature, those driving the value of Bitcoin may soon crash and burn.

On December 22, Bitcoin lost some 40% of its highest value. Some have even described the week before Christmas 2017 as the worst in five years for the cryptocurrency, which, in the last months of 2017, had everyone believing in Santa Claus and magic. (Source: “Bitcoin plunges 30% as ‘sharks’ circle in the cryptocurrency’s biggest test yet,” The Financial Post, December 22, 2017.)

It may or may not be a coincidence that gold moved up by almost a full percentage point.

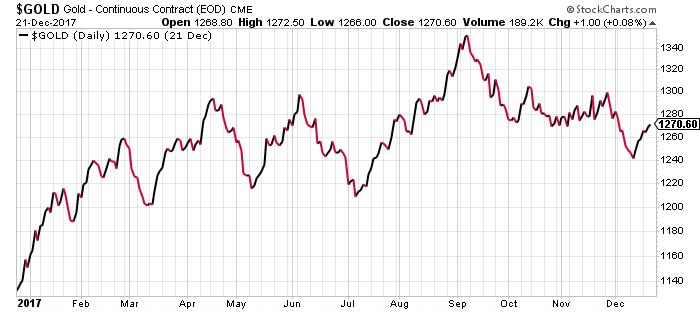

As the gold chart for 2017 shows, the range in prices went from just under $1,140 per ounce at the start of the year to a high just shy of $1,360 per ounce in September.

Chart courtesy of StockCharts.com

The takeaway is that gold’s traditional function as a safe-haven investment has not changed. When the gold price reached its yearly peak, it was a period of intense international risk. North Korea was firing nuclear-warhead-capable rockets near Japan and Donald Trump seemed ready to launch a missile strike. That caused a minor stock market correction. It’s also when the Bitcoin motors started to fire up.

Bitcoin Has Drawn Attention Away from Gold

Since September, gold never dropped below a threshold of $1,240 per ounce, but Bitcoin was stealing all the limelight. Its rise, which many have likened to the tulip bulb mania (“Tulipmania”) of the 17th century, could only have happened if some traditional and conservative investors also started to follow the flock of cryptocurrency believers.

Indeed, while the Bitcoin bears linked its success to the same market forces that inflated the first market bubble in history (the aforementioned one about tulip bulbs), the bulls saw it as the new gold.

But gold will take its shine back. One of the reasons that gold prices dropped or failed to break into the $1,400s is that the Federal Reserve raised interest rates and the stock market continued along that other Tulipmania-like phenomenon that has been Wall Street in 2017. But interest rates went up with Janet Yellen and the stalled Trump tax cuts in Congress. Both those influencing factors have changed.

The Tax Cuts Will Prevent the Fed from Raising Rates

Trump’s massive corporate tax cut may or may not help boost inflation, but the next Federal Reserve Chair, Jerome Powell is reluctant to raise rates. He knows that doing so could trigger a massive stock market collapse, if one doesn’t happen before he takes over in February 2018.

Moreover, the tax cuts could add trillions of dollars to the already-exorbitant U.S. national debt. Raising interest rates again could push the interest payments alone to some $200.0 billion annually (if the debt were to remain at the present level). Imagine how higher interest rates would affect massively indebted Americans, already struggling to pay off student loans, mortgages, and car loans.

Therefore, rather than an easing of market fears, the Trump tax cuts, the risks of a market implosion, and the runaway debt suggest that interest rates will stay the same—or even reverse in order to absorb the rising risk of a market collapse. If you are one of the investors who share Warren Buffett’s concerns over Bitcoin, you will be expecting cryptocurrencies and Bitcoin to be cut down to size. (Source: “Bitcoin-mania stock volatility shows the fallacy of ‘efficient markets’,” CNBC, December 22, 2017.)

The end of “Bitcoin mania” may be already upon us, even though it is known for gaining and losing as much as 30%–40% in a matter of days or hours. In 2018, it will be different. International tensions are higher than they were a year ago.

And, with the tax bill behind him, Trump may start to move on North Korea again, which, he said, could get a “bloody nose.” (Source: “U.S. preparing ‘bloody nose’ attack on North Korea,” New York Post, December 21, 2017.)

The reaction to that “bloody nose,” if it comes, is unpredictable. But it’s more than reasonable to expect gold prices to recover in 2018; they may even rally.